LET’S TALK ABOUT WRITE-OFFS.

WHAT THEY ARE AND HOW CAN WE GET MORE OF THEM.

(also, remember you pay for it)

The Basics

tax deduction / taks dih-duhk-shuhn / noun :

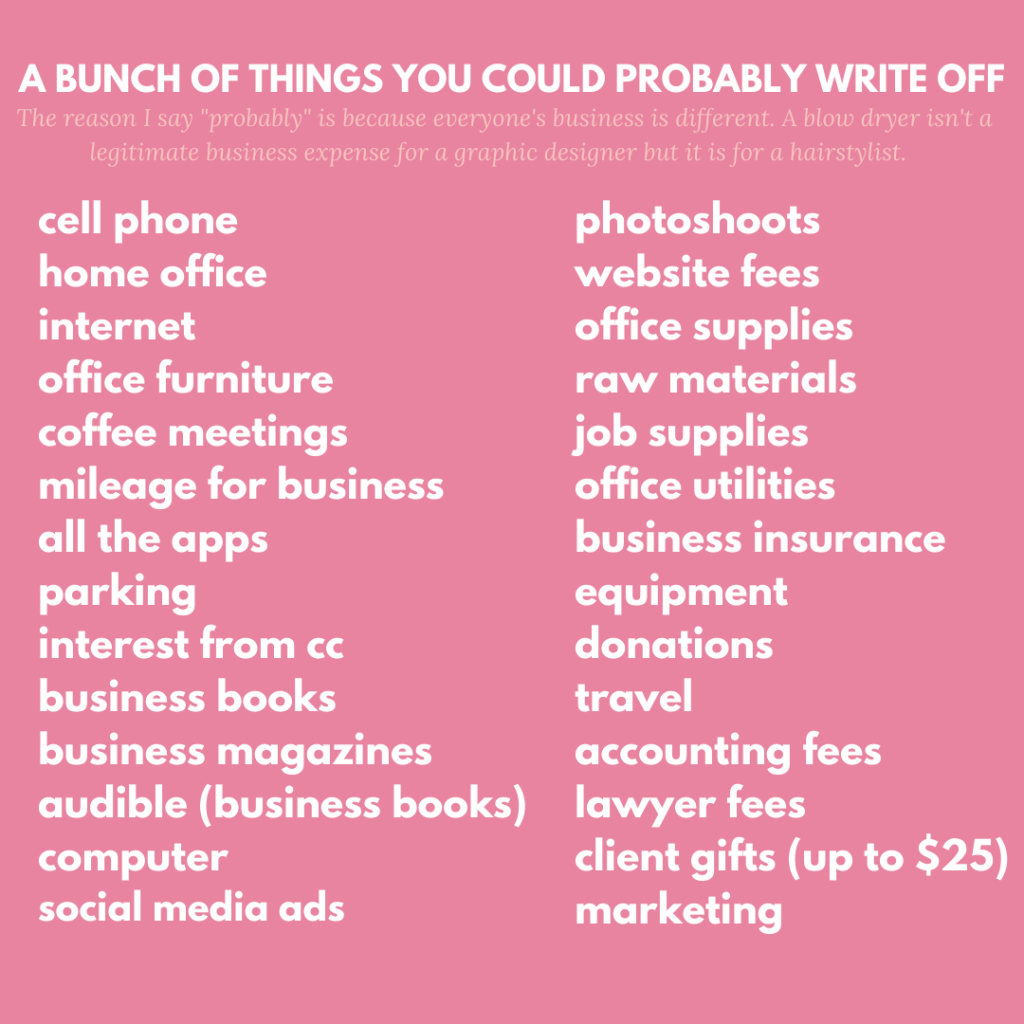

Buying something “ordinary and necessary” for your business and then using that amount to lower the income you have made. Click here to see what the IRS has to say about tax deductions.

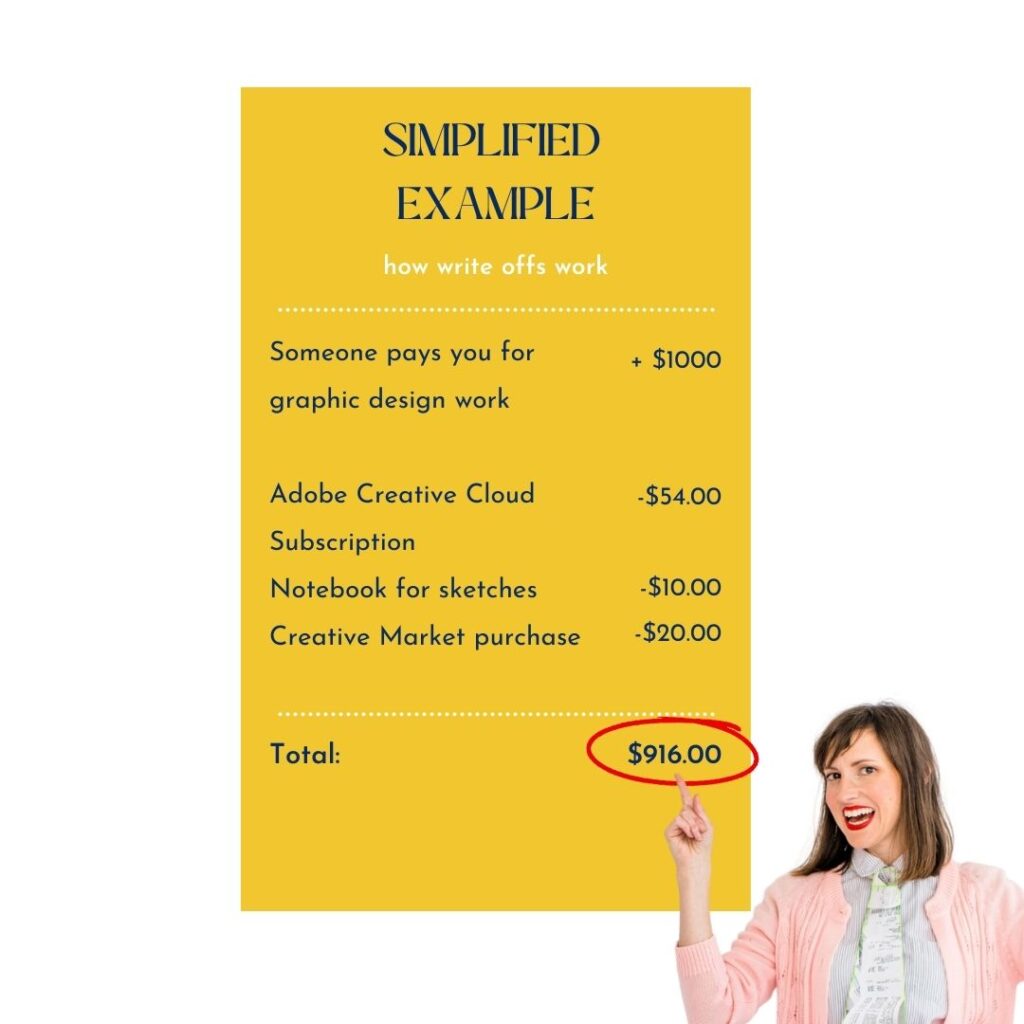

THAT MEANS you aren’t paying income tax on $1,000 – you’re paying it on $916 because those supplies count as a write-off. The more business expenses you have, the more your taxable income is lowered – MEANING YOU PAY FEWER TAXES

It grinds our gears when we hear a small business owner say, “The IRS already knows what I owe, can’t they just send me a bill?” NO, they don’t. You have to tell them how much money you made AND all the wonderful and many business expenses you have that lower your taxable income. That’s the game.

You always want to make sure you are making money and following the rules.

HERE’S WHY YOU SHOULD CARE

YOU OWE LESS IN TAXES.

(If you haven’t already)

1. Get Quickbooks Simple Start (this is always going to be our number #1 piece of advice), so that you can organize all your tax deductible expenses.

At the end of the year, give a P&L and a Balance Sheet (which you create in Quickbooks) to your CPA and they can go through your business expenses and determine what is tax deductible (lowers your income) and how much.

THAT IS HOW YOU “WRITE IT OFF”

2. Have a separate business checking account. (Please, keep your business and personal accounts separate.) This insures that at the end of the year, you don’t have to find business expenses in your personal bank/credit card accounts.

3. KEEP A PAPER TRAIL. The thing about tax deductible business expenses is that you need proof. Make sure you are getting receipts for EVERYTHING and saving them online. Also, download the Quickbooks app and snap photos of your receipts.

4. Get a CPA. If you don’t have one already, get one. Ideally, find one who works with businesses like yours. They are going to know the best ways to save your tax dollars in your field.

View comments

+ Leave a comment