Let’s keep this short and sweet, since your Profit & Loss (or P&L) is basically the lifeblood of your business. This report is why you need to use bookkeeping software, like Quickbooks.

Below, we’ve got a video that shows you how to read this report, and how to make sure it’s working as hard as you are for your business.

STEP 1: GET YOUR BOOKS IN SHAPE

In order to have a clear picture of your business’s finances, you need to stay on top of your bank feed, register, bank account and reconciliations in Quickbooks. All of this information is what ends up on your Profit & Loss report, which is a HUGE part of understanding your overall business health.

STEP 2: RUN THE REPORT

We recommend running this report monthly (along with your Balance Sheet, but we’ll get to that next time).

STEP 3: HOW DO I USE THIS INFORMATION

A P&L shows two things: income (sales) and expenses (loss).

It’s important to know where your income is coming from, so that you can make decisions based on what is most profitable. You might think you know how much money you brought in that month, but until it shows up on your P&L, you can’t count it towards the big picture.

It’s ALSO important to see where your money is going. Having all of your expenses broken down into categories helps you budget! All it takes is a one glance down the list to know where you could make improvements, or what expenses are absolutely necessary.

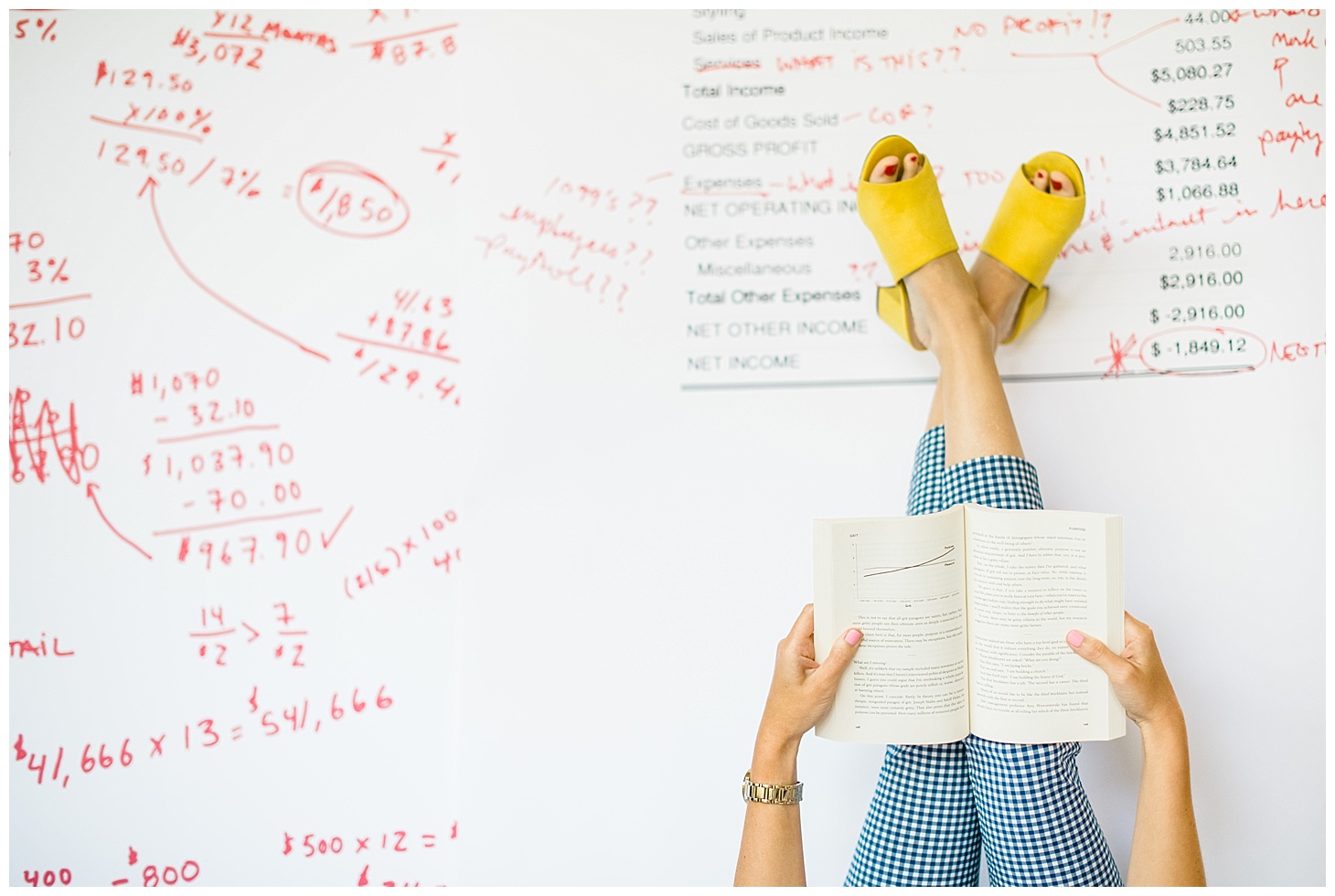

HERE’S AN EXAMPLE OF A P&L TO PRACTICE READING IT!

You can tell by looking at this P&L that Cool Design Co is making the most income from products being sold and their utilities bill is pretty high.

A P&L combines all of your expenses from all your accounts, like checking and credit cards.

A FEW LAST NOTES

- This is honestly one of the most important tools you have to manage your business.

- A P&L is only as good as the bookkeeping work you’re putting into it.

[…] the end of the year, give a P&L and a Balance Sheet (which you create in Quickbooks) to your CPA and they can go through your […]